KGV, KBV, KUV – Der Kennzahlenwahnsinn

Inhalt Puh, Börse ist doch nicht „e wie einfach“ Das KGV, KBV, KUV und wie die ganzen Kennzahlen heißen, ist für jeden Börsenneuling

On 4 August, 3M reported on the Company website announced that they will carry out a split-off for the area of food safety. This is to take place this month. But what is a split-off and does it really make sense?

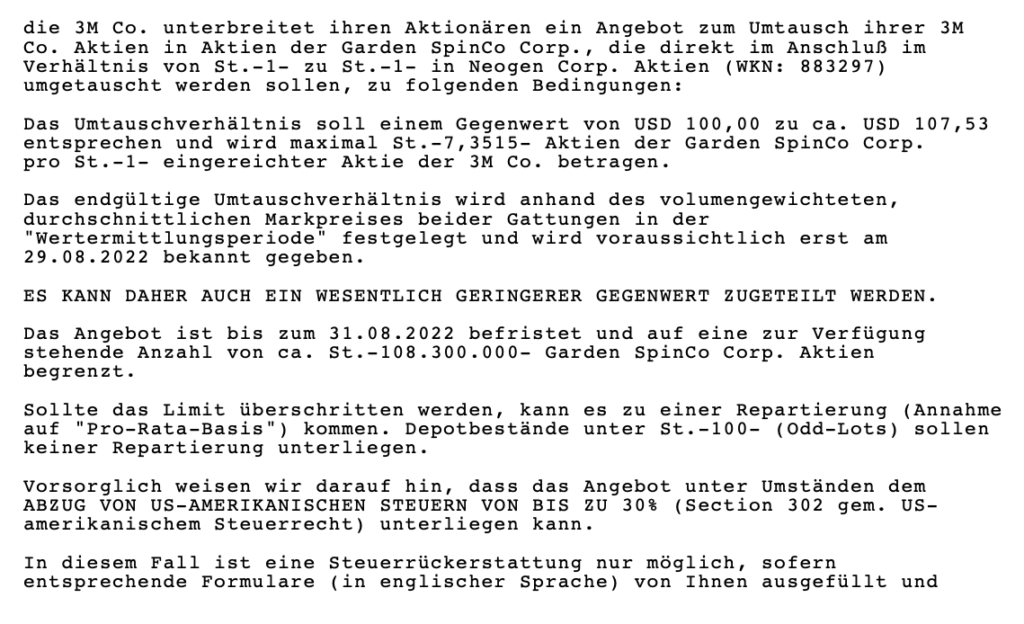

3M is currently undergoing a restructuring. This includes the announced spin-off of the healthcare division and now also a split-off of the food safety division. As an investor, I recently received an email from my broker. It looks like this:

But how should I decide and is this an attractive offer? To answer this question, I first need to understand how this exchange will take place.

In a split-off, a part of the company, in this case the food safety division, is spun off and becomes an independent company. The difference with a spin-off is that investors have to choose one side. And for this reason it is also called an exchange. Usually such a split-off takes place after an IPO and based on the market price, the offer to shareholders is then determined. As in this offer, the price offered is usually higher than the price of the parent company. Applied to this case, this means that a part of 3M is spun off. This spin-off is then merged with Neogen.

So if I were to decide to exchange, I would exchange all my current 3M shares for Neogen Corp. shares. Now, of course, the question also arises "What does Neogen Corp. do?".

The Neogen Corp. tests food and issues corresponding certificates. If, for example, a food producer wants to have a product labelled as "vegan", it is tested by Neogen and then a certificate is issued. After the merger, an annual turnover of about 1 billion USD is to be generated and in the first year the EBITDA should be about 300 million USD. The company is already listed on the stock exchange and describes itself as a market leader in the food safety industry. Since the announcement of the merger, the share price has fallen by 50%.

I have been a 3M investor since early 2022 and have a savings plan on the stock. One of the most important reasons why I invested in 3M is that they have been raising dividends for 64 years and are one of the few dividend kings. Since Neogen has not paid a dividend so far, I don't want to change my strategy and give up the great dividends. On the other hand, this does not mean that Neogen is not an interesting company. Above all, the merger will make them number 1 in the food safety sector and the market conditions are not bad either.

If you would like to discover more dividend kings, you are welcome to use our Dividend App. myDividends24 use. Here you get access to over 2000 stocks and ETFs and can even create a portfolio and add the stocks you want. Here you can find more details for this. Download now free of charge and test it for 7 days.

Each company should be carefully analysed before making an investment decision because the dividend yield alone should not be an impulse for an investment. Of course, you can minimise the risk with ETFs, but you should still be aware that you are an investor and should know which companies you invest in and why. Because wrong decisions can lead to a total loss. So if you are not sure, contact us and we can provide you with a fundamental analysis of the respective company and list the strengths and weaknesses of the company.

Learn more about myDividends24

Inhalt Puh, Börse ist doch nicht „e wie einfach“ Das KGV, KBV, KUV und wie die ganzen Kennzahlen heißen, ist für jeden Börsenneuling

Inhalt ist eine Anlagestrategie, bei der Anleger Aktien von Unternehmen kaufen, die regelmäßige Dividendenzahlungen ausschütten. Das Ziel dieser Strategie ist es, ein regelmäßiges

Inhalt Viele Anleger fragen sich ständig, warum Aktien fallen, nachdem die Ergebnisberichte der Unternehmen veröffentlicht wurden, besonders, wenn die Entwicklung laut des Berichts

© 2023 mydividends24.de