KGV, KBV, KUV – Der Kennzahlenwahnsinn

Inhalt Puh, Börse ist doch nicht „e wie einfach“ Das KGV, KBV, KUV und wie die ganzen Kennzahlen heißen, ist für jeden Börsenneuling

If you receive dividends from abroad, withholding taxes are first due in most countries. But how high is this tax in the respective countries and in which countries do you not pay withholding tax? We answer these and other questions for you in today's article.

Germany has a so-called double taxation agreement with many countries. This agreement prevents the so-called double taxation of dividends and interest. In this country, the capital gains tax is 25% and if you had to pay, for example, 25% withholding tax beforehand, that would be 50% tax and thus an investment abroad would no longer be worthwhile. To prevent this, this so-called double taxation agreement was introduced. This means that the withholding taxes paid are credited by the German state and one can pays less capital gains tax. So that in the end you usually get back to the 25%.

The following table shows how much withholding tax is due in the respective countries and what percentage the German state credits us for this.

| Country | Withholding tax | Creditable |

|---|---|---|

| Australia | 30% | 15% |

| Belgium | 25% | 15% |

| Denmark | 27% | 15% |

| Estonia | 7% | 7% |

| Finland | 35% | 15% |

| China | 20% | 10% |

| Great Britain | 0% | 0% |

| India | 20% | 10% |

| Ireland | 0% | 0% |

| Iceland | 22% | 15% |

| Italia | 26% | 15% |

| Japan | 15% | 15% |

| Canada | 25% | 15% |

| South Korea | 20% | 15% |

| Croatia | 10% | 10% |

| Liechtenstein | 0% | 0% |

| Luxembourg | 15% | 15% |

| Netherlands | 15% | 15% |

| Norway | 25% | 0% |

| Austria | 27,5% | 15% |

| Poland | 19% | 15% |

| Portugal | 28% | 15% |

| Russia | 15% | 15% |

| Sweden | 30% | 15% |

| Switzerland | 35% | 15% |

| Spain | 19% | 15% |

| Taiwan | 21% | 10% |

| Turkey | 15% | 15% |

| USA | 30% | 15% |

As soon as the withholding tax exceeds 15%, this is a disadvantage for us German investors. Because then we pay in the end actually more than 25% tax. You can see how such a calculation is carried out in the following example.

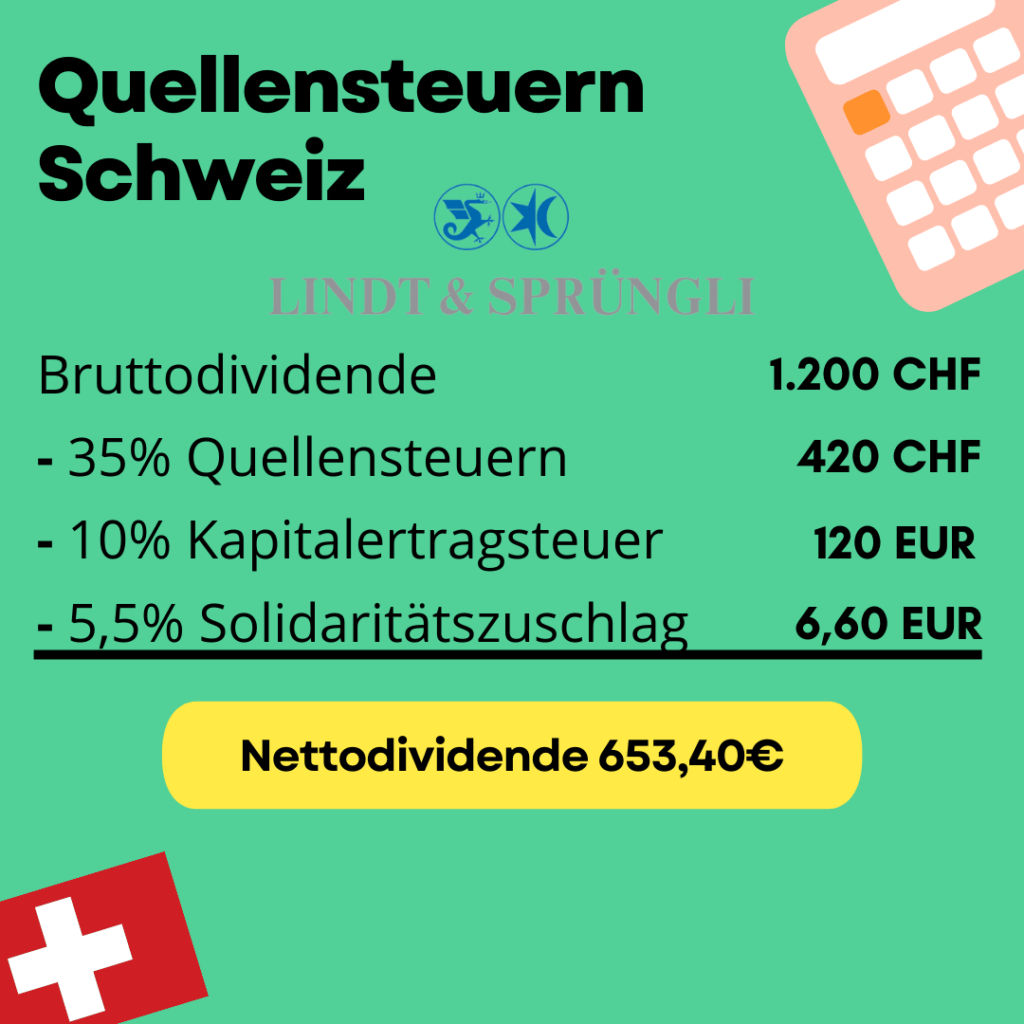

In this example, an investor has 10 shares of Chocoladefabriken Lindt & Sprüngli AG in his portfolio. The dividend payment takes place on 05.05.22 and the dividend amounts to 120CHF.

For the sake of simplicity, we have assumed an exchange rate of 1:1 for the calculation. However, once the withholding tax has been calculated and deducted, it should be converted into the correct currency. As shown in the table above, 15% of the withholding tax from Switzerland is creditable in Germany. This means that we deduct the creditable 15% from the 25% capital gains tax. This leaves us with only 10% capital gains tax. From the calculated capital gains tax we then have to calculate the 5.5% solidarity surcharge. In this case, we pay more than 45% tax on the dividends from Switzerland.

Withholding taxes in the US are normally 30%. However, you can reduce this to 15% if you choose the right custodian bank. There is a special legitimation requirement for this, which is known as the "Qualified Intermediary". If the custodian bank or broker fulfils this legitimation requirement, only 15% withholding tax is levied on investors.

Those who do not wish to pay any withholding tax can invest in companies in the United Kingdom, Ireland, Singapore or Liechtenstein. However, the 25% capital gains tax and the solidarity surcharge will then apply again.

If too much tax has been paid, we can claim back the difference from the respective source state. There is a simple formula for the refundable amount. Here we subtract the creditable from the withholding tax and what remains we can theoretically reclaim. We will save how we can reclaim this for a separate article, because that would go beyond the scope of today.

If you would like to discover more dividend stocks or ETFs, you are welcome to use our Dividend App. myDividends24 use. Here you get access to over 2000 stocks and ETFs and can even create a portfolio and add the stocks you want. Here you can find more details for this. Download now free of charge and test it for 7 days.

Each company should be carefully analysed before making an investment decision because the dividend yield alone should not be an impulse for an investment. Of course, you can minimise the risk with ETFs, but you should still be aware that you are an investor and should know which companies you invest in and why. Because wrong decisions can lead to a total loss. So if you are not sure, contact us and we can provide you with a fundamental analysis of the respective company and list the strengths and weaknesses of the company.

Learn more about myDividends24

Inhalt Puh, Börse ist doch nicht „e wie einfach“ Das KGV, KBV, KUV und wie die ganzen Kennzahlen heißen, ist für jeden Börsenneuling

Inhalt ist eine Anlagestrategie, bei der Anleger Aktien von Unternehmen kaufen, die regelmäßige Dividendenzahlungen ausschütten. Das Ziel dieser Strategie ist es, ein regelmäßiges

Inhalt Viele Anleger fragen sich ständig, warum Aktien fallen, nachdem die Ergebnisberichte der Unternehmen veröffentlicht wurden, besonders, wenn die Entwicklung laut des Berichts

© 2023 mydividends24.de