KGV, KBV, KUV – Der Kennzahlenwahnsinn

Inhalt Puh, Börse ist doch nicht „e wie einfach“ Das KGV, KBV, KUV und wie die ganzen Kennzahlen heißen, ist für jeden Börsenneuling

When is the best time to start a savings plan, the 1st or the 15th of the month? Many investors have probably already asked themselves this question. We have found the ideal buying day for us and would like to share this information with you.

First of all, it is important to know whether the selected stock is a distributing stock or ETF. We assume here that the stocks are distributing and do not take into account the accumulating or non-distributing stocks and ETFs. This topic is particularly relevant for shares & ETFs that pay dividends several times a year.

Each broker and bank offers different options for the purchase days. At Comdirect, investors can choose between the following purchase days: the 1st, 7th, 15th or the 23rd. Other brokers such as TradeRepublic even offer the 20th or 25th.

However, until now we have not really been able to answer the question for the ideal day to buy. But now we have been able to find a strong argument for the buying day. The purchase day for the savings plan should be based primarily on the ex-dividend day of the share or ETF.

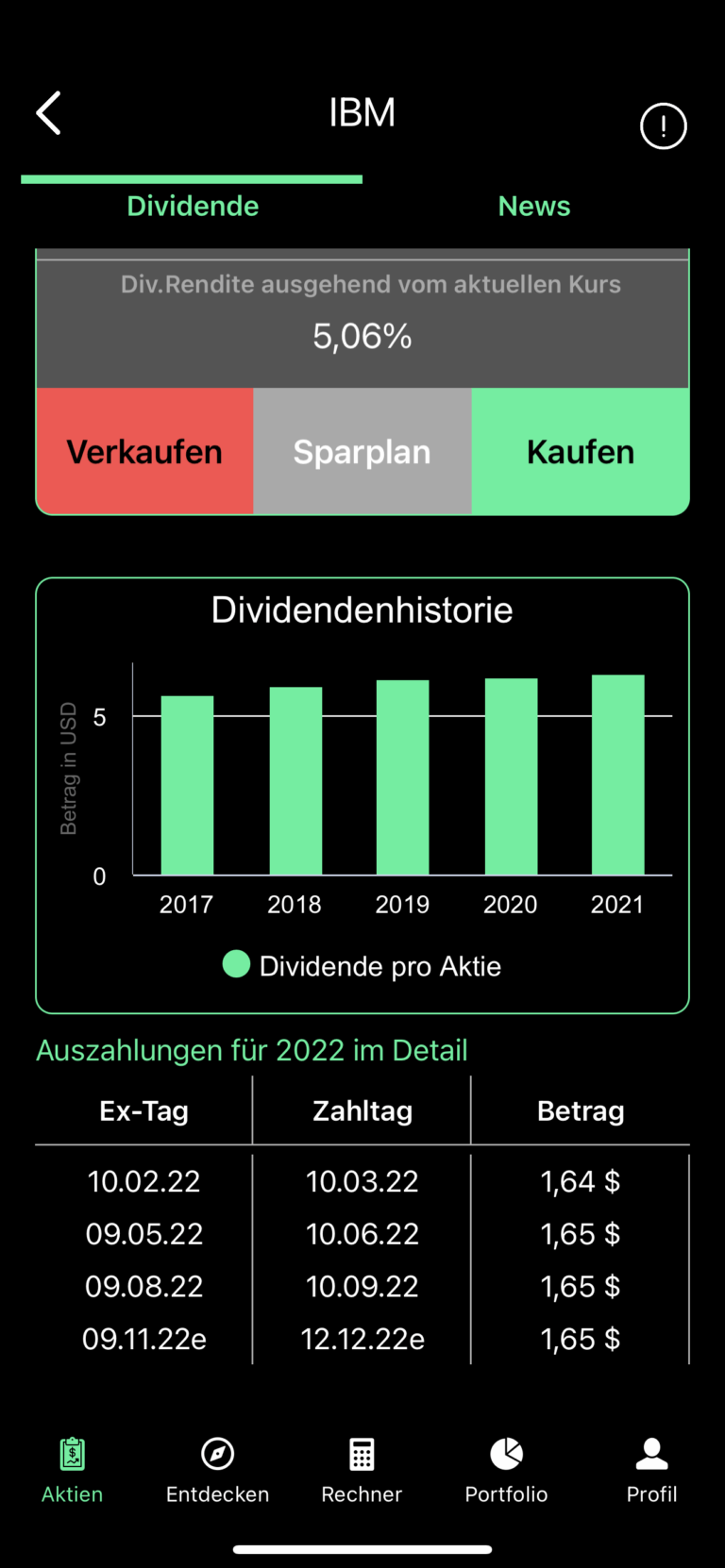

The purchase day of a savings plan should ideally always be before the ex-dividend day. This means that if the ex-dividend day of a share is always towards the middle or end of a month, the purchase day should understandably be before this. The following example shows the IBM share

The ex-days of the IBM share are usually the 10th or 9th of a month. This means that one could start the savings plan on the 1st, 2nd or 7th because the purchases can then also benefit from the respective payout before the actual ex-days. However, if this was selected on the 15th, in this case the purchase would take place after the ex-day and the last transaction could not benefit from the dividend. And depending on the amount saved, this can of course play a big role in the long run. The following calculation example may help you to understand this better.

In the following example, I have simulated two savings plans, each with a savings rate of €100 for the Realty Income share. The interval here is monthly and this started in January 2012. For one savings plan, the purchase day is the 1st and for the other savings plan I have chosen the 23rd of a month.

Start: 01.01.2012 and always on the 1st of a month

Start: 01.01.2012 and always on the 23rd of a month

As you can see in both screenshots, the dividend from the savings plan that executes the transaction on the 1st is higher than the one on the 23rd. Extrapolated to the year 2022, that's about €5 more in dividends. Projected over the 10 years, this adds up to quite a bit of capital. If you then consider that you reinvest the dividends received, this can mean a few more shares in the portfolio in the end. So not zu unterschätzen.

So if you still have savings plans that are possibly after the ex-day, you can still optimise them now and you will have a little more dividends left to reinvest. I hope we were able to help you optimise your portfolio and save the day 🙂 Feel free to leave us comments on what you think about it and how you go about it.

If you would like to discover more dividend stocks or ETFs, you are welcome to use our Dividend App. myDividends24 use. Here you get access to over 3000 stocks and ETFs and can even create a portfolio and add the stocks you want. Here you can find more details for this. Download now free of charge and test it for 7 days.

Each company should be carefully analysed before making an investment decision because the dividend yield alone should not be an impulse for an investment. Of course, you can minimise the risk with ETFs, but you should still be aware that you are an investor and should know which companies you invest in and why. Because wrong decisions can lead to a total loss. So if you are not sure, contact us and we can provide you with a fundamental analysis of the respective company and list the strengths and weaknesses of the company.

Learn more about myDividends24

Inhalt Puh, Börse ist doch nicht „e wie einfach“ Das KGV, KBV, KUV und wie die ganzen Kennzahlen heißen, ist für jeden Börsenneuling

Inhalt ist eine Anlagestrategie, bei der Anleger Aktien von Unternehmen kaufen, die regelmäßige Dividendenzahlungen ausschütten. Das Ziel dieser Strategie ist es, ein regelmäßiges

Inhalt Viele Anleger fragen sich ständig, warum Aktien fallen, nachdem die Ergebnisberichte der Unternehmen veröffentlicht wurden, besonders, wenn die Entwicklung laut des Berichts

© 2023 mydividends24.de