KGV, KBV, KUV – Der Kennzahlenwahnsinn

Inhalt Puh, Börse ist doch nicht „e wie einfach“ Das KGV, KBV, KUV und wie die ganzen Kennzahlen heißen, ist für jeden Börsenneuling

Dividend aristocrats are companies that have continuously increased their dividends for at least 25 consecutive years. But which are the top 4 dividend aristocrats?

In short, dividend aristocrats are 50 to 60 S&P 500 companies that have increased their dividends uninterruptedly for at least 25 consecutive years.

Furthermore, the following selection criteria apply in order to be classified as a dividend aristocrat:

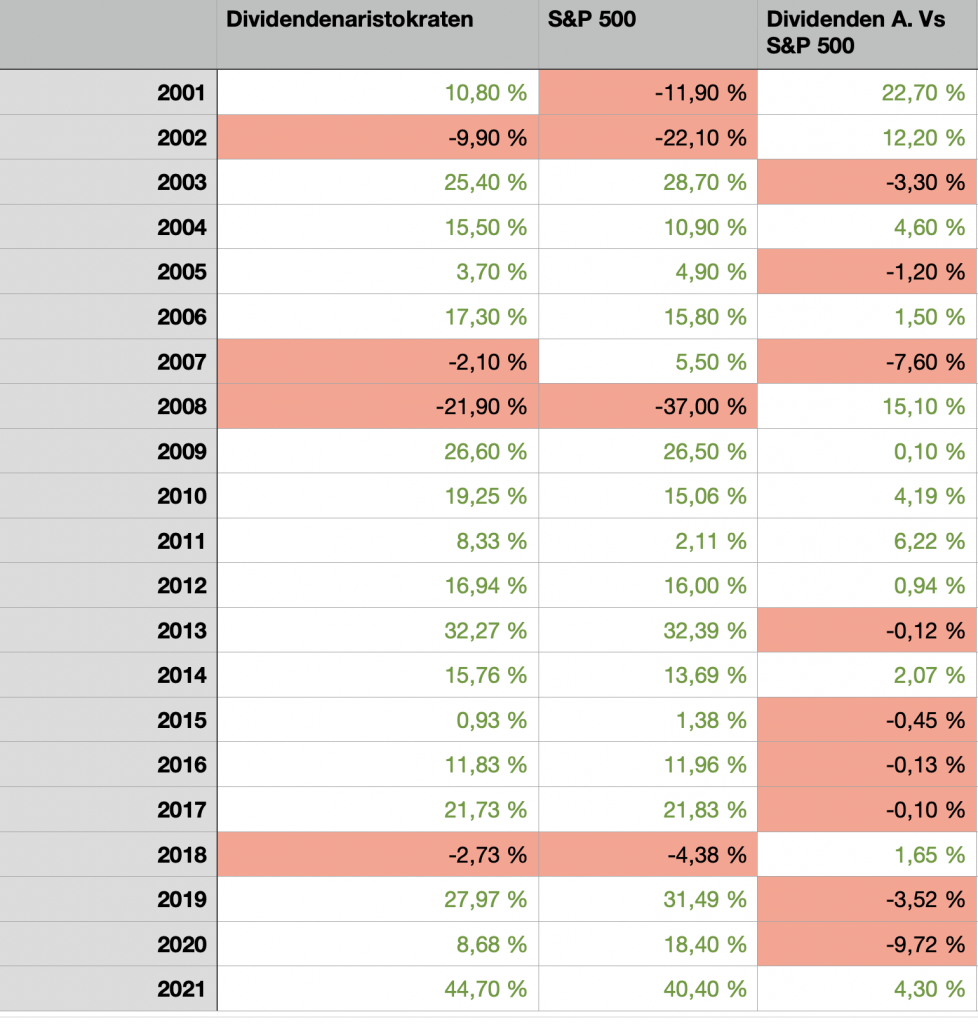

The table on the left compares the performance of the NOBL (Dividend Aristocrats ETF) over the last 20 years with the S&P 500.

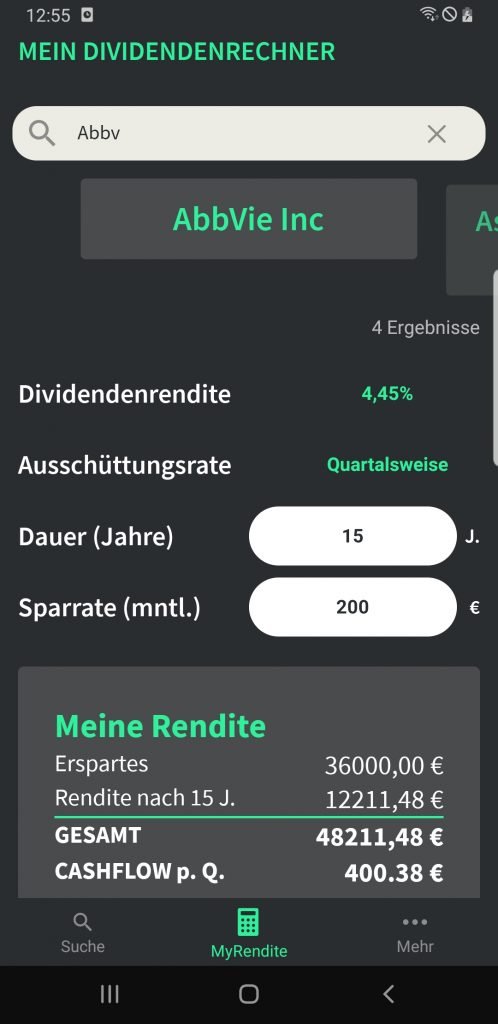

AbbVie is an American publicly traded biopharmaceutical company founded in 2013. It was formed as a spin-off from Abbott Laboratories, which was founded in 1888. The company has been distributing profits since 1927 and has increased its dividends for 49 consecutive years.

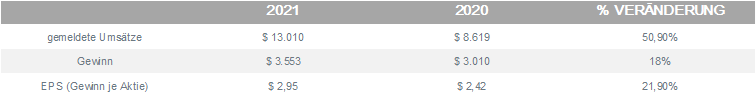

The following are the published on 30 April 2021. Q1 2021 results:

Turnover of $13 billion increased by 50.9 % compared to the same quarter last year. Earnings per share increased by 21.9 % from $2.42 to $2.95. Below is a calculation example with the same savings plan:

After 15 years, the total capital (savings + return) is €48,211. In addition, from the 15th year onwards, one receives €400 every 3 months. This corresponds to a passive income of €133 per month. In other words, AbbVie pays for your Netflix subscription, Spotify subscription, your fitness club membership and there is even something left over.

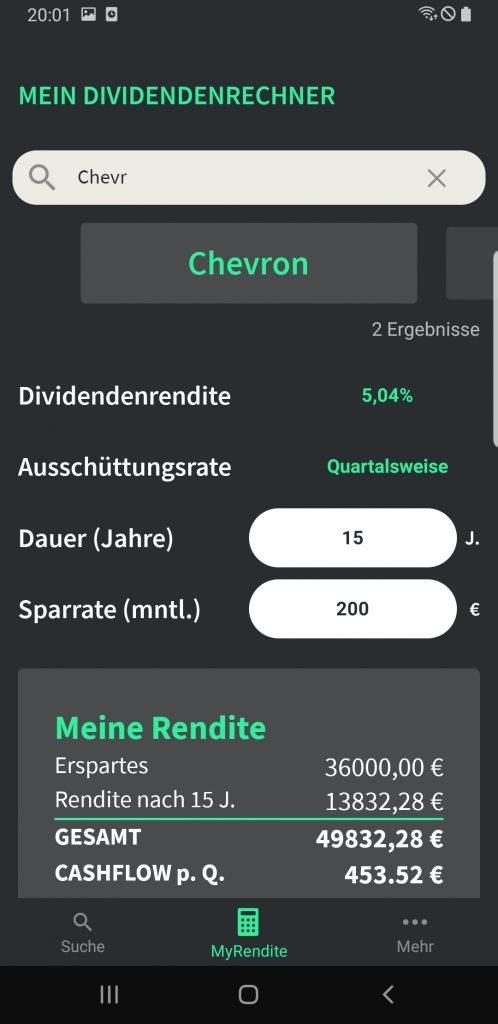

Chevron Corporation (CVX) is one of the largest and best-known oil stocks in the world. It is also one of the most stable, having increased its dividend for 33 consecutive years. Because of the industry's dependence on high commodity prices for profitability, there are only two energy stocks on the Dividend Aristocrats list - Chevron and Exxon Mobil (XOM). Chevron stands out for its dividend consistency and stability in the otherwise volatile energy industry.

The current dividend yield is 5.04%. If the dividend yield remains the same, the same savings plan will yield the following return:

After 15 years, the total capital (savings + return) amounts to € 49,832. In addition to this, one receives €453 every 3 months from the 15th year onwards. This corresponds to a passive income of €151 per month. In other words, Chevron gives its shareholder an all-inclusive package holiday for two every year.

As already mentioned, there are only two oil & gas companies among the dividend aristocrats. These two also have their raison d'être.

Exxon Mobil Corporation is an American multinational oil and gas corporation headquartered in Irving, Texas. It is the largest direct descendant of John D. Rockefeller's Standard Oil, and was formed on 30 November 1999 through the merger of Exxon and Mobil. ExxonMobil's major brands are Exxon, Mobil, Esso and ExxonMobil Chemical.

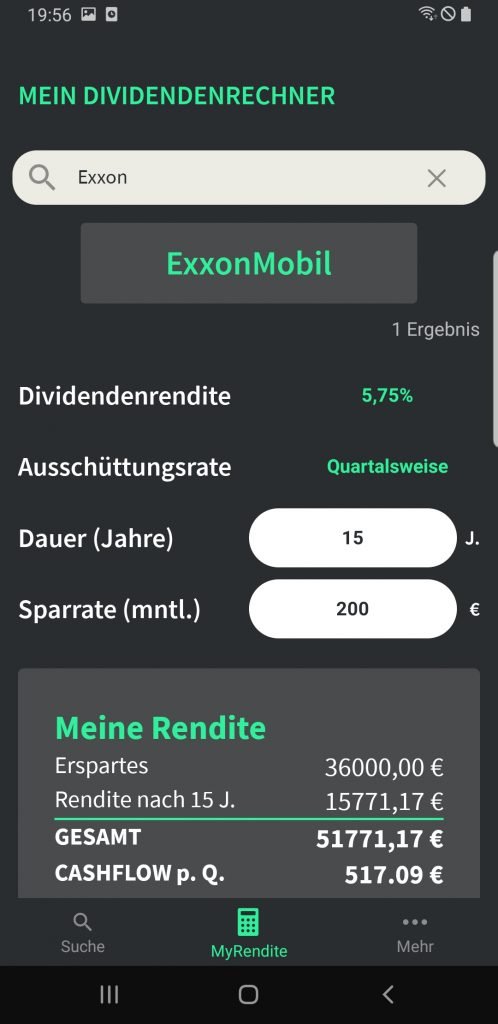

The company currently pays a dividend yield of 5.75%. Assuming a constant dividend yield (price development or dividend cuts are not taken into account in this calculation) and a savings plan with a savings rate of €200 and a duration of 15 years, the capital development looks as follows:

After 15 years, the total capital (savings + return) is € 51,771. In addition to this, one receives €517 every 3 months from the 15th year onwards. This corresponds to a passive income of €172 per month. In other words, ExxonMobil supports the next financing of a car, relieves the account of a not-so-small sum or the savings plan itself pays (almost) the monthly savings instalment every three months.

AT&T Inc. is a U.S. multinational conglomerate holding company headquartered in Whitacre Tower in downtown Dallas, Texas, and registered in Delaware. It is the largest telecommunications company in the world and the second largest provider of wireless services. In 2020, AT&T was ranked 9th in the Fortune 500 ranking of the largest companies in the United States, with revenues of $181 billion.

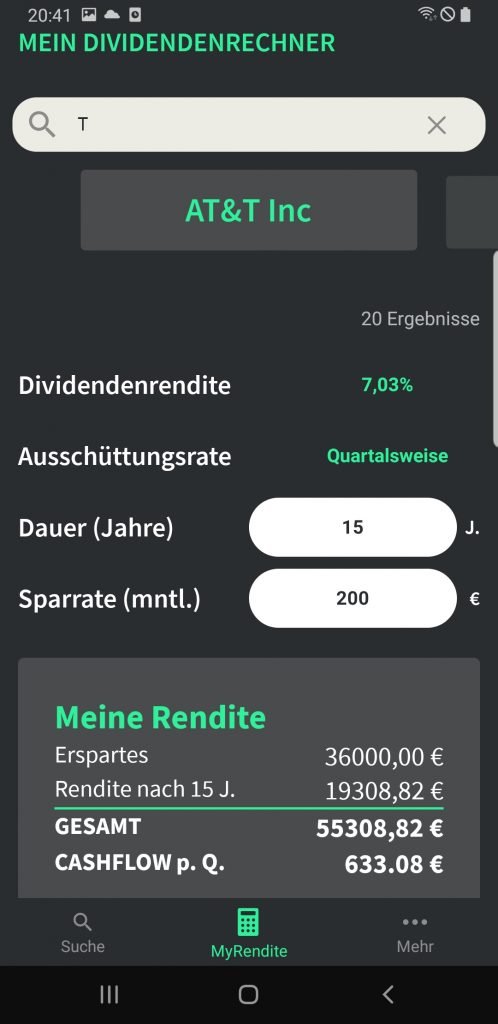

AT&T pays its shareholders an impressive dividend yield of 7.03%. With a constant dividend yield (price development or dividend cuts are not taken into account in this calculation) and the same savings plan, the capital development is as follows:

After 15 years, the total capital (savings + return) amounts to € 55,308. In addition to this, one receives € 633 every 3 months from the 15th year onwards. This corresponds to a passive income of € 211 per month. What you can do with the 211 € more per month - we leave that to your imagination. Write it down in the comments.

What did you think of this article? Leave us some feedback or show us and other readers what your savings plan looks like. We look forward to your comments.

If you would like to discover more dividend stocks or ETFs, you are welcome to use our Dividend App. myDividends24 use. Here you get access to over 2000 stocks and ETFs and can even create a portfolio and add the stocks you want. Here you can find more details for this. Download now free of charge and test it for 7 days.

Learn more about myDividends24

Inhalt Puh, Börse ist doch nicht „e wie einfach“ Das KGV, KBV, KUV und wie die ganzen Kennzahlen heißen, ist für jeden Börsenneuling

Inhalt ist eine Anlagestrategie, bei der Anleger Aktien von Unternehmen kaufen, die regelmäßige Dividendenzahlungen ausschütten. Das Ziel dieser Strategie ist es, ein regelmäßiges

Inhalt Viele Anleger fragen sich ständig, warum Aktien fallen, nachdem die Ergebnisberichte der Unternehmen veröffentlicht wurden, besonders, wenn die Entwicklung laut des Berichts

© 2023 mydividends24.de