KGV, KBV, KUV – Der Kennzahlenwahnsinn

Inhalt Puh, Börse ist doch nicht „e wie einfach“ Das KGV, KBV, KUV und wie die ganzen Kennzahlen heißen, ist für jeden Börsenneuling

A dividend savings plan is particularly useful if you have set yourself financial goals linked to a passive income. But what is the best way to set up a savings plan?

Many people ask themselves how they can best save money or even how they can best invest their money so that they can even generate a passive income every month. The answer to such a question would of course be to set up a dividend savings plan with companies that pay out high dividends. However, many people who ask themselves this question do not know exactly at which bank or how such a dividend savings plan is set up and what costs are involved. They also don't know which companies to invest in and how risky such an investment is. In this article you will learn how such a process works and in the end you can set up your savings plan and start saving. Above all, it is also a great New Year's resolution.

Most public limited companies in Germany pay dividends only once a year, whereas most American companies pay dividends four times a year. The advantage here is of course the liquidity and the passive income. As soon as the dividend savings plan starts, shares of the selected company are bought every month at the set amount. When the payday is due, you receive the dividends for the number of shares. As the number of shares in the company increases each month, so does the dividend. Another advantage of the so-called dividend aristocrats is that they increase the dividend year after year. This means that you receive higher and higher payouts over the years, firstly because of the increasing number of shares and secondly because of the increasing dividends.

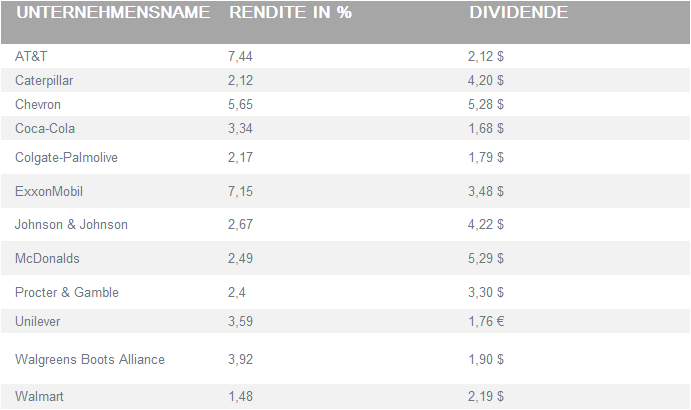

There are many companies that pay dividends, but it is important to make the right choice. Here it is important to choose a so-called dividend aristocrat. These are companies that have continuously increased their dividends for at least 25 years. Below you will find a selection of companies that belong to the category of dividend aristocrats.

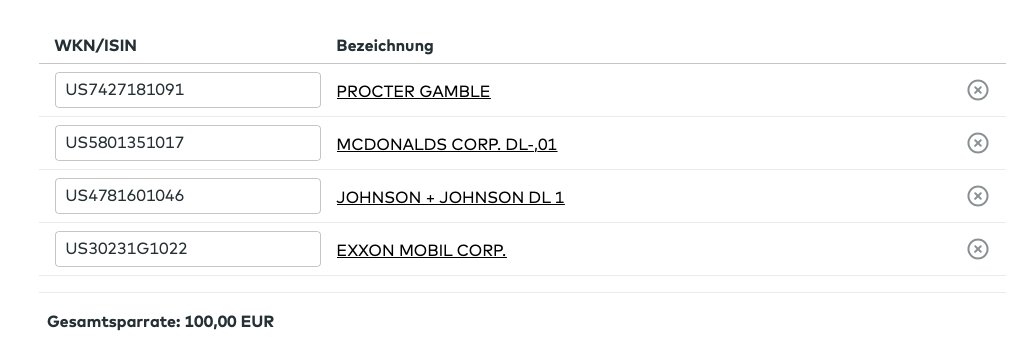

I myself have a securities account at Comdirect and show you how you can easily create a dividend savings plan there. After you have logged in, you can go to your personal area, click on investment and then on securities savings plan. You will then be asked how much you would like to invest per month. The minimum amount for an investment is €25. Let's assume that we want to invest €100 per month. After you have entered the amount, you will be asked to enter the companies in which you would like to invest. You can either enter the ISIN code or the WKN code of the selected company.

Of course, you can also choose only two companies. Then you would invest €50 each instead of €25 in four companies. After you have set the amount and selected the companies, click Next.

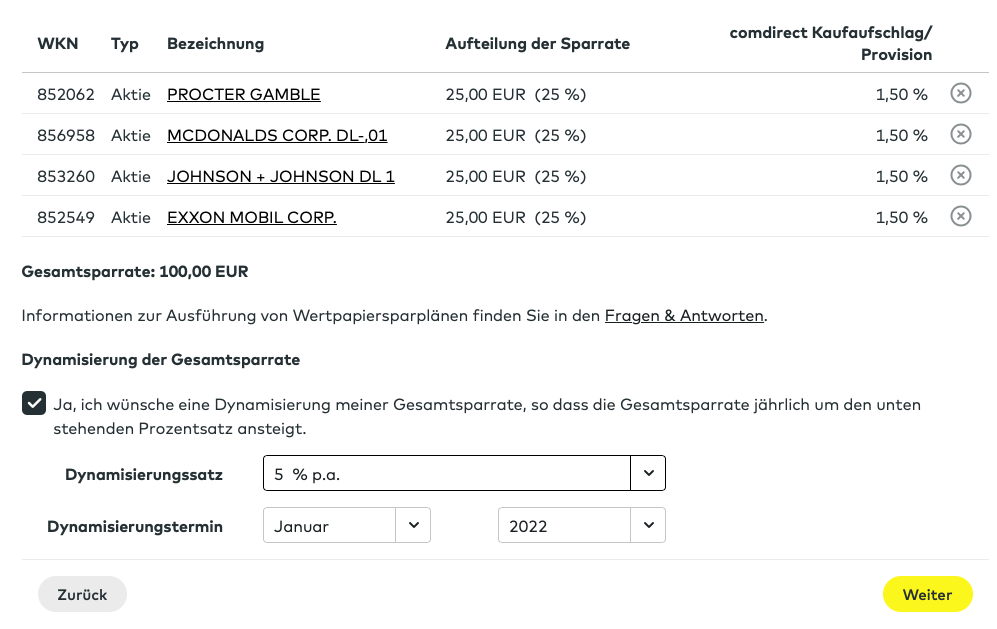

Now you can select whether you want dynamic modification. This dynamisation means that you can set the savings rate to automatically increase annually by the selected dynamisation rate. This means that the savings rate can be adjusted to inflation or rising income. In the last step, you only have to enter a few pieces of information.

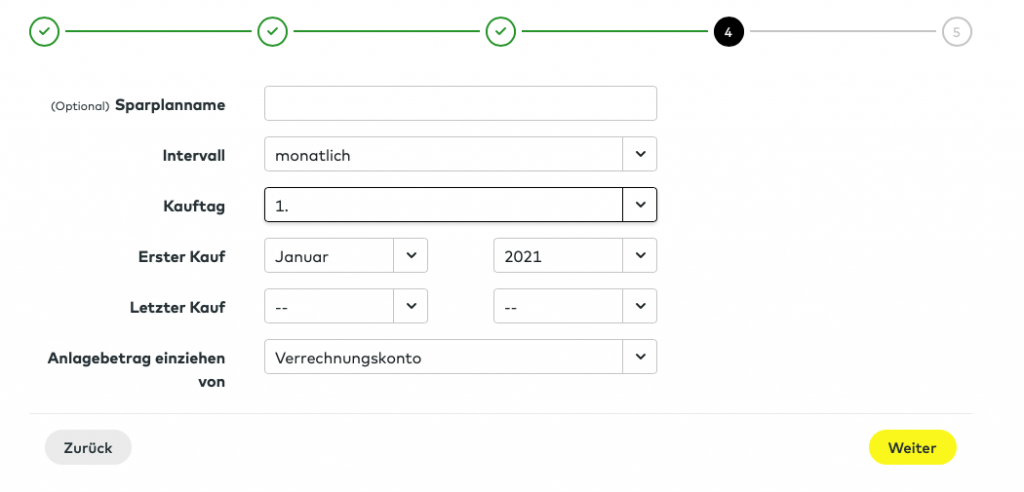

First you have to define a name. Then you can set an interval, whether you want to invest monthly, bi-monthly or quarterly. You also have to set the day of purchase. Here we have the option to invest on the 1st, 7th, 15th or 23rd of each month. The item First purchase is the month and the year on which the savings plan is to begin. Last but not least, you have to select the account from which the amount is to be deducted. I find it very practical that Comdirect also offers SEPA direct debit so that you can enter your private account and do not have to transfer money to the Comdirect securities account every month.

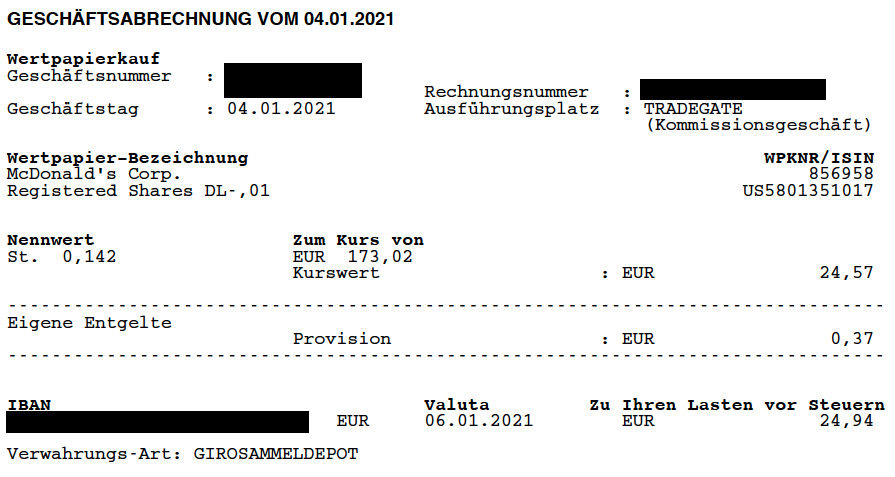

Opening and maintaining a securities account at Comdirect Bank is free of charge. There are also no costs for setting up a dividend savings plan. The first costs start with the purchase of the share. As you can see on the screenshot of such a securities statement, fees of €0.37 were charged for an investment of €25. This is 1.5% of the amount invested. These are due with every purchase. Otherwise, there are no further costs.

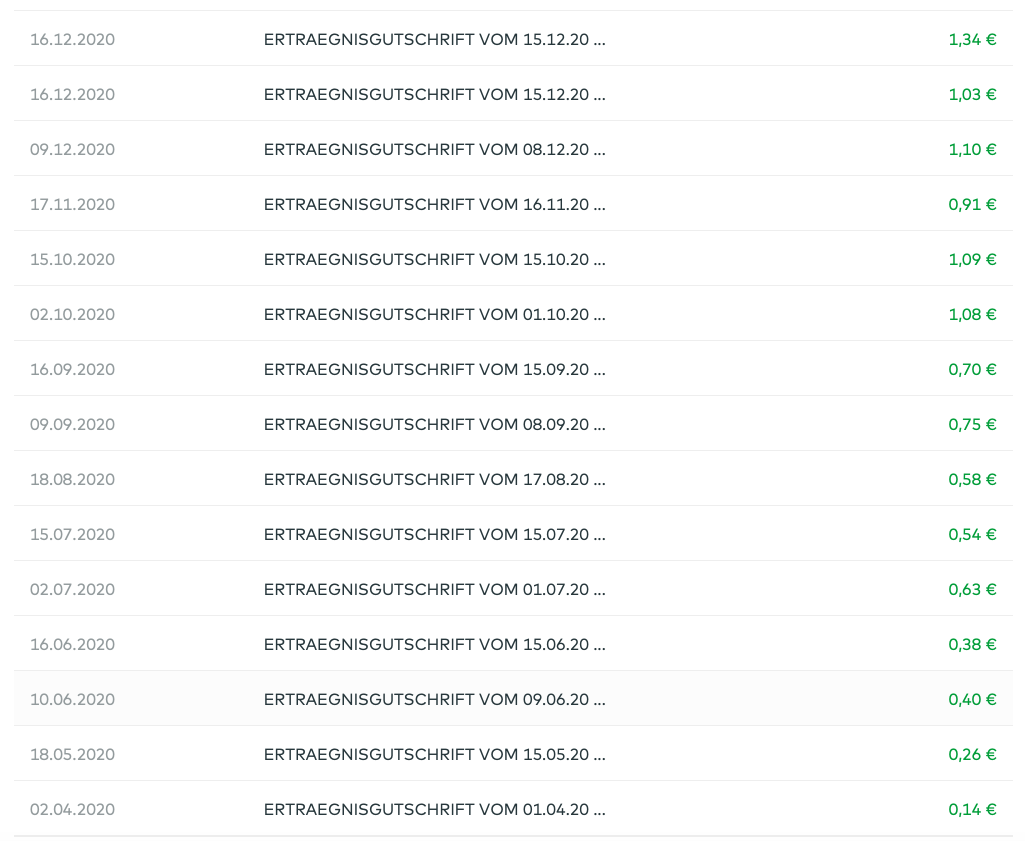

I have created a dividend savings plan in March 2020 and have deposited a statement of all dividends from this savings plan here. In this savings plan, €100 per month is invested in four so-called dividend aristocrats.

As you can see, I already received the first dividend of €0.14 in April. Since then, I have received dividends every month at least once or even several times. You can also see that they are increasing from month to month.

I think the dividend savings plan is great. Especially in the current interest rate situation, the money in the bank account is not in good hands. If you add inflation to that, it's even a minus deal. Another big advantage is that you don't have to worry about share prices. Because if the prices fall, you get more shares in the company and can even be happy about it. If the share price rises, you also get a share price gain in addition to the dividends. So no matter whether prices are falling or rising, the investor can always be happy.

If you liked the article, please leave a comment and if you don't have a dividend savings plan yet, you can definitely set one up now. If you want to invest more and are looking for value stocks, you can also check out our Aktienanalysen read through.

Here is another Link to Comdirect Bank for opening a deposit. If you open the page via the link, we also receive a small commission.

If you would like to discover more dividend stocks or ETFs, you are welcome to use our Dividend App. myDividends24 use. Here you get access to over 2000 stocks and ETFs and can even create a portfolio and add the stocks you want. Here you can find more details for this. Download now free of charge and test it for 7 days.

Learn more about myDividends24

Inhalt Puh, Börse ist doch nicht „e wie einfach“ Das KGV, KBV, KUV und wie die ganzen Kennzahlen heißen, ist für jeden Börsenneuling

Inhalt ist eine Anlagestrategie, bei der Anleger Aktien von Unternehmen kaufen, die regelmäßige Dividendenzahlungen ausschütten. Das Ziel dieser Strategie ist es, ein regelmäßiges

Inhalt Viele Anleger fragen sich ständig, warum Aktien fallen, nachdem die Ergebnisberichte der Unternehmen veröffentlicht wurden, besonders, wenn die Entwicklung laut des Berichts

© 2023 mydividends24.de