KGV, KBV, KUV – Der Kennzahlenwahnsinn

Inhalt Puh, Börse ist doch nicht „e wie einfach“ Das KGV, KBV, KUV und wie die ganzen Kennzahlen heißen, ist für jeden Börsenneuling

WestRock (WRK), one of the largest packaging companies in the world, cut its dividend during the height of the Corona pandemic. From 0.465 US dollars to just 0.2 US dollars per quarter.

About 2.5 years ago, WestRock cut its dividend during the pandemic, but the company has just achieved their record fourth quarter sales. How does the share look today? And can one speak of a comeback for WestRock?

WestRock, or WRK for short, is an American paperboard and packaging manufacturer formed in 2015 from a merger of MeadWestvaco and RockTenn. Das Unternehmen hat sich auf die Herstellung und Vermarktung von Karton und Verpackungen für Getränke und Lebensmittel sowie kosmetische und pharmazeutische Produkte spezialisiert. Darüber hinaus entwickelt der Konzern Immobilienaktivitäten und stellt Spezialchemikalien für die Bereiche Transport, Energie und Infrastruktur her. Ende September 2021 betrieb WestRock 312 Produktionsstätten (davon 192 eigene) in der ganzen Welt, auch in Deutschland gibt es mehrerer Niederlassungen, beispielsweise in Trier und Melle. Mit einem Umsatz 2017 von knapp 15 Milliarden US-Dollar und über 51.000 Mitarbeitern weltweit (Stand 2020), ist der Konzern der zweitgrößte Verpackungsmittelhersteller der USA.

Considering how much packaging material was used during the Corona pandemic (online orders, ordering food, etc.) it is quite surprising that WestRock cut its dividends. The cut was about 57%, considering that dividends dropped from $0.465 to $0.2 per quarter.

Schon damals waren sich viele Leute einig, dass dieser Schritt nicht notwendig gewesen wäre, jedoch wollte das Unternehmen durch diesen Schritt die Möglichkeit ergreifen, um langfristig Schulden und Verbindlichkeiten abzubauen. Während einer so unvorhersehbaren Zeit, wie es die Corona-Pandemie war, war es das Ziel von WestRock finanziell flexibel und abgesichert zu bleiben. Das Vorhaben wurde von Erfolg gekrönt und WestRock konnte seine Schulden von über 9 Milliarden US-Dollar auf etwa 7,5 Milliarden US-Dollar senken.

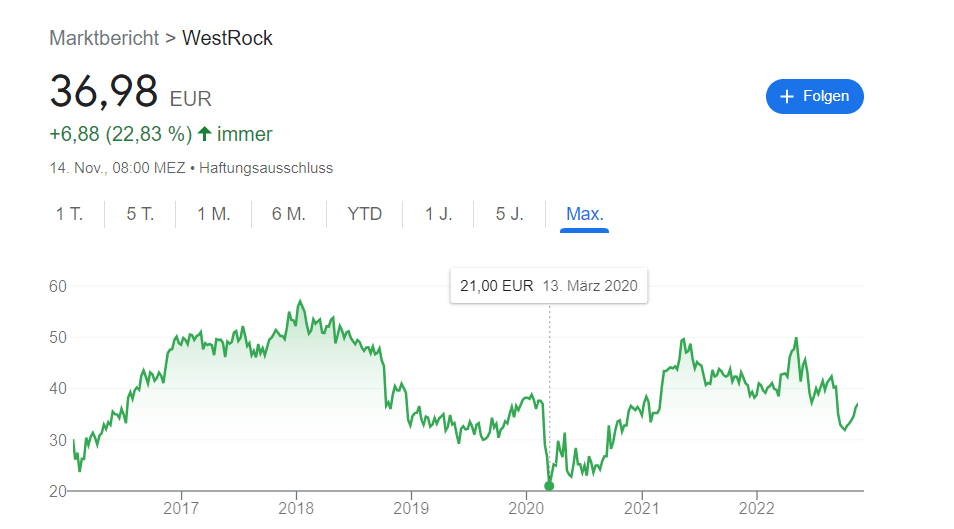

After the dividend cut was announced, the share fell from well over 30 euros to just 21 euros at the low point in March 2020.

As can be seen in the share performance, WestRock has risen by 50% since the pandemic and has lost about 14% to 15% again this year, but this does not seem to stand in the way of the comeback. WestRock COULD make a big comeback, the parameters for it, so far, are right. Record sales, rising profits and dividend payouts.

WestRock is currently not only reviving its dividends, but all the figures point to a rosy future. As with the last Profit publication WestRock achieved an increase in turnover of 5.4 billion US dollars compared to 5.1 billion US dollars in the previous year. Net profit also saw growth of over $20 million. In addition, WestRock has bought back about 5% of its own shares in the past 12 months. By comparison, in September last year there were still 269 million shares on the market, today there are only 256 million.

This is, among other things, the reason why earnings per share rose from 1.20 US dollars to 1.34 US dollars. This means a growth of 11%, which is an excellent value for a company in the packaging industry.

But let's get to the interesting part: We will take a closer look at the WestRock share on the basis of three key figures. First, the price-earnings ratio, second, the dividend payout ratio and third, the dividend growth rate. With a price-earnings ratio of 8,56x WestRock is well below the price/earnings ratio of the S&P500, which is around 20x.

With a dividend payout ratio of 28,3% ($0.275/quarter or $1.10/year), WestRock's dividend is low and very safe. However, the dividend should increase in the coming years.

Since the dividend was cut to $0.2 per share per quarter, the dividend has since increased again to $0.275. In the period since 2020, the dividend has already been 3 times increased und für das kommende Jahr ist die nächste Erhöhung in Aussicht. Der Konzern nimmt also wieder ein stetes Dividendenwachstum auf, was ein sehr gutes Zeichen für alle Anleger ist.

Finally, let's take a quick look at the dividend yield. WestRock's current dividend yield is 2.99% (as of 14.11.2022). This is by no means a particularly high dividend yield in the current market, but it is not a bad one either.

Nachdem wir uns nun die Kennzahlen der WestRock-Aktie genauer angeschaut haben, kommt nun die Frage, lohnt es sich in das Unternehmen zu investieren?

For all those who want to further diversify their equity portfolio, WestRock offers a good opportunity, as future growth potential is definitely there. Personally, I would still like to see the dividend yield increase further, but only time will tell.

Attention: This is solely the opinion of the author and not direct investment advice!

If you would like to discover more dividend stocks or ETFs, you are welcome to use our Dividend App. myDividends24 use. Here you get access to over 2000 stocks and ETFs and can even create a portfolio and add the stocks you want. Here you can find more details for this. Download now free of charge and test it for 7 days.

Inhalt Puh, Börse ist doch nicht „e wie einfach“ Das KGV, KBV, KUV und wie die ganzen Kennzahlen heißen, ist für jeden Börsenneuling

Inhalt ist eine Anlagestrategie, bei der Anleger Aktien von Unternehmen kaufen, die regelmäßige Dividendenzahlungen ausschütten. Das Ziel dieser Strategie ist es, ein regelmäßiges

Inhalt Viele Anleger fragen sich ständig, warum Aktien fallen, nachdem die Ergebnisberichte der Unternehmen veröffentlicht wurden, besonders, wenn die Entwicklung laut des Berichts

© 2023 mydividends24.de