KGV, KBV, KUV – Der Kennzahlenwahnsinn

Inhalt Puh, Börse ist doch nicht „e wie einfach“ Das KGV, KBV, KUV und wie die ganzen Kennzahlen heißen, ist für jeden Börsenneuling

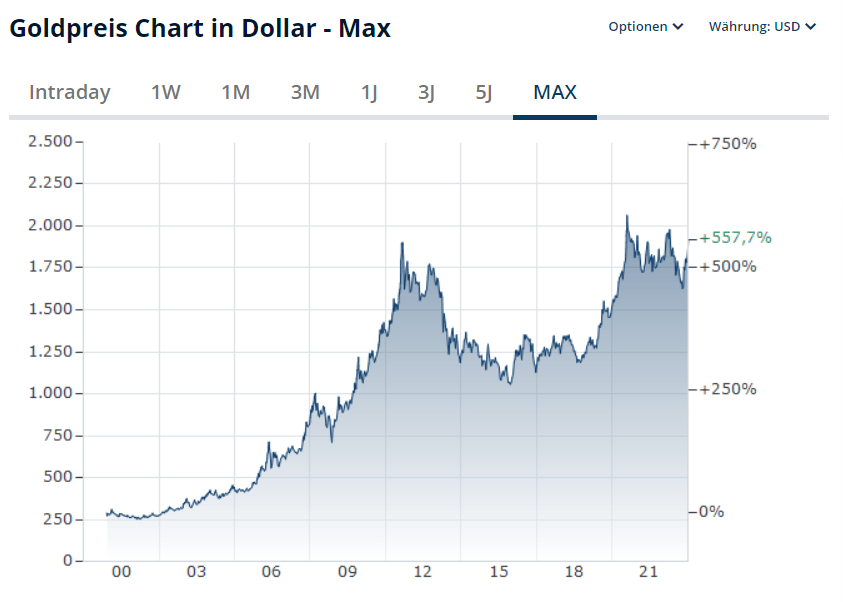

Before we start deeper into the article, I would like to mention at the beginning that I would speak only conditionally of investments in gold and silver. Although the price of gold in particular has increased by over 20% since 2019, it is not foreseeable that such an increase will occur again. For this reason, I would consider precious metals more as a hedge against hyperinflation, a weakening euro, or a general economic crisis. Thus, precious metals are seen as a way to diversify, which could both increase in value in the future or in times of crisis, but do not have to do so.

Nevertheless, precious metals are seen as an investment by many people. For this reason, this term is also used in the following article.

Gold and silver have one big advantage over other investment options, they are physical. That means gold and silver can be touched, felt, seen, and if you like, even stored in your house.

Gold and silver are also very easy to turn into money. It is much easier to find a buyer for gold and silver at the current rate than it is, for example, for a house or a car.

The euro is falling, inflation keeps rising and things are not going well economically either. Here, gold and silver can be a good option to protect yourself financially. Thus, precious metals can protect against hyperinflation, as they mostly remain stable in value even in times of crisis, and can even rise.

When an economic crisis erupts, investors flock to gold and silver. As a result, demand drives up prices, which can offer other early investors a hedge against inflation.

While the prices of precious metals can also fluctuate with supply and demand, they have the great advantage of being infinitely durable and offering intrinsic value. Thus, gold and silver are not theoretical intangible assets, as stocks or similar investment assets often are these days.

Gold, for example, has been used as a medium of exchange and purchase for thousands of years. Also, compared to food, for example, which spoils over time, precious metals cannot "go bad". For this reason, gold and silver are also particularly suitable as a long-term investment.

In short, gold and silver will never be worthless!

As with all physical assets, there is also the problem with gold and silver:

Where do I store them?

Viele Menschen haben einen Tresor zu Hause, andere zahlen extra Geld an Banken oder andere Institute, die diese Wertanlagen lagern. Denn wie bei allen anderen physischen Wertanlagen gibt es auch bei Edelmetallen das Risiko eines Diebstahls.

Unlike stocks or ETFs, which pay dividends, for example, precious metals have no cash flow.

Of course, it would be nice if from a gold bar, coins would sprout, but this is not the case.

Especially with gold, even in small quantities, the purchase can be expensive. When buying precious metals, you often have to pay premiums or taxes on top of the actual purchase price.

There are also some advantages to investing in gold and silver, but also some disadvantages.

In general, it can be said that gold and silver, compared to many other forms of investment, are crisis-proof.

However, this crisis security also has its price. Thus, it is not possible for investors to generate cash flow with precious metals.

The hope of all investors should be that one is never forced to sell precious metals, as this would mean that there is severe economic turmoil.

So precious metals, in my view, are probably more suitable as a hedge than as an investment.

If you would like to discover more dividend stocks or ETFs, you are welcome to use our Dividend App. myDividends24 use. Here you get access to over 2000 stocks and ETFs and can even create a portfolio and add the stocks you want. Here you can find more details for this. Download now free of charge and test it for 7 days.

Inhalt Puh, Börse ist doch nicht „e wie einfach“ Das KGV, KBV, KUV und wie die ganzen Kennzahlen heißen, ist für jeden Börsenneuling

Inhalt ist eine Anlagestrategie, bei der Anleger Aktien von Unternehmen kaufen, die regelmäßige Dividendenzahlungen ausschütten. Das Ziel dieser Strategie ist es, ein regelmäßiges

Inhalt Viele Anleger fragen sich ständig, warum Aktien fallen, nachdem die Ergebnisberichte der Unternehmen veröffentlicht wurden, besonders, wenn die Entwicklung laut des Berichts

© 2023 mydividends24.de